Newsletter on Including Crypto-Assets Service Providers into The Scope of Regulation on Measures Regarding the Prevention of Laundering Proceeds of Crime and Financing of Terrorism

Crypto-assets service providers have been regulated as obliged party under the Regulation on Measures Regarding the Prevention of Laundering Proceeds of Crime and Financing of Terrorism (“Regulation”) with the amendment made on the Regulation on Amending the Regulation on Prevention of Laundering Proceeds of Crime and Financing of Terrorism published on the Official Gazette dated May 1, 2021 and numbered 31471.[1] The Regulation regulates the principles and procedures regarding obliged parties, obligations, sanctions to prevent the laundering proceeds of crimes and financing of terrorism in accordance with the Law on Prevention of Laundering Proceeds of Crime (“Law”).

Financial Crimes Investigation Board (“MASAK”) has published a guide (“Guide”) on the fundamental principles of the obligations regarding prevention of laundering proceeds of crime and financing of terrorism for crypto-assets service providers.

Crypto-assets service providers[2] are liable according to the Regulation and the Guide. The obligations of the all obliged parties in order to prevent the laundering proceeds of crimes and financing of terrorism are as follows:

- Obligation of Know Your Client

As per Article 5 of the Regulation and the Article 3 of the Law, obliged parties are required to take necessary precautions before the conclusion of the transaction conducted or mediated by themselves for persons carrying out transactions and persons on behalf or for the benefit of whom the transactions are conducted. . The most important precaution is identification.

Since the crypto-assets service providers can carry out transactions by executing a contract with the

users who will receive service from these platforms and successive transactions can be carried out according to the membership based on this contract, , the business relation is determined as “continuous business relation”. In accordance with the Regulation, in the event that a continuous business relation is established, it is required to identify the users with whom the contract is signed and those who act on behalf or account of these users by obtaining the information regarding the identity regardless of the amount and confirming the accuracy of this information.

Crypto-asset service providers are also obliged to identify the users, “When the transaction amount or the total amount of more than one related transactions is seventy five thousand TRY or more, When the transaction amount in electronic transfers or the total amount of more than one related transactions is seven thousand five hundred TRY or more, Regardless of the amount in cases that require notification of suspicious transactions, Regardless of the amount in case of doubt about the adequacy and accuracy of customer identification information previously obtained.”

- Obligation of Notification of Suspicious Transaction

As per the Articles 27 and 30 of the Regulation and Article 4 of the Law, suspicious transactions[3] must be reported to MASAK within ten working days at the latest from the date of suspicion, and immediately in cases where delay is inconvenient, regardless of any amount.

- Obligation of Providing Information and Documents

As per Article 31 of the Regulation and the Article 7 of the Law; public institutions and organizations, real persons, legal entities and non-legal entities are responsible with providing any kind of information, document that might be requested by the audit persons and MASAK and related records at any platform and all information and passwords correctly and necessary convenience to provide access to these records or make them readable.

Persons from whom information and documents are requested shall not avoid providing any information and documents by alleging the provisions of special laws, provided that the defense right is reserved.

- Obligation of Preservation and Submission

As per Article 46 of the Regulation and Article 8 of the Law, the obliged persons, shall preserve the documents for eight years from the date of issuance, the books and records from the last registration date, and the documents related to identification from the last transaction date regarding obligations and transactions regulated under aforementioned Law and submit to the authorities if requested.

- Obligation of Continuously Informing

As per Article 32 of the Regulation and Article 6 of the Law, crypto-asset service providers are obliged to continuously inform MASAK within the principles and procedures determined by the Ministry of Finance regarding the transactions to which they are parties or intermediaries exceeding the amount determined by the Ministry.

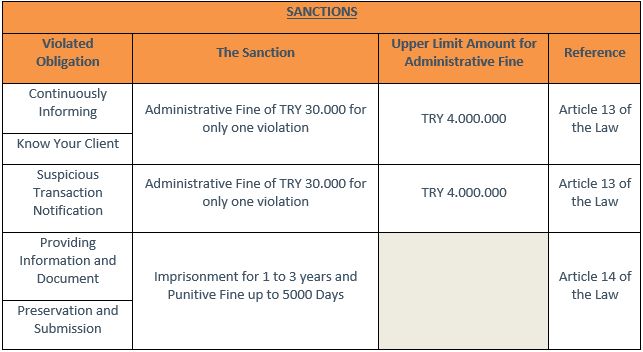

The sanctions according to the relevant Articles of the law are as follows:

[3]Under Article 27 Paragraph 1 of the Regulation, suspicious transactions is defined as “any information, suspicion or presence of a matter requiring suspicion when asset subject to transactions made or attempted to be made before or through liable persons is obtained illegally or used for illegal purposes, used for terrorist acts or by terrorist organizations, terrorists or terrorist financiers, or related associations with them.”